Evil Bush Tax Rates Made Rich Bastards Pay More Taxes!

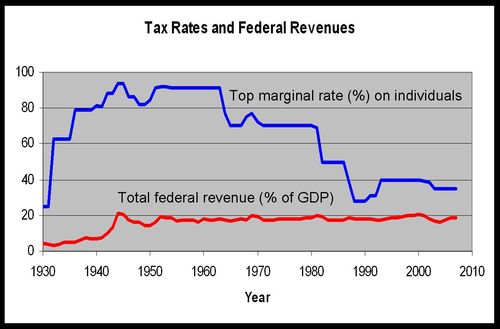

Reason.com: “For all the yammering about the wisdom or tragedy of extending Bush-era tax rates, precious little hot air has been expended on, like, looking at what effects the goddamn things had on who paid how much tax. Back during the 2008 election, . . . the rich (however defined) have been paying a greater share of income taxes in the aughts. Below is a chart from the Tax Foundation that lists the percent of federal income tax paid by each income group. Whatever else you want to say about the Bush tax rates, they made the wealthy pony up more of the whole.”