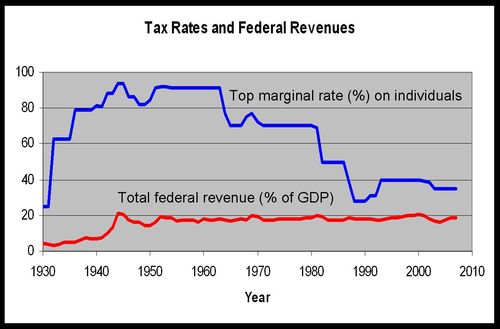

Wall St. Journal: “Tax revenues as a share of GDP have averaged just under 19%, whether tax rates are cut or raised. Better to cut rates and get 19% of a larger pie. Even amoebas learn by trial and error, but some economists and politicians do not. The Obama administration’s budget projections claim that raising taxes on the top 2% of taxpayers, those individuals earning more than $200,000 and couples earning $250,000 or more, will increase revenues to the U.S. Treasury. The empirical evidence suggests otherwise. None of the personal income tax or capital gains tax increases enacted in the post-World War II period has raised the projected tax revenues.

Leave A Comment

You must be logged in to post a comment.