Beware of IRS’ 2010 “Dirty Dozen” Tax Scams

IR-2010-32, March 16, 2010

The Internal Revenue Service today issued its 2010 “dirty dozen” list of tax scams, including schemes involving return preparer fraud, hiding income offshore and phishing. “Taxpayers should be wary of anyone peddling scams that seem too good to be true,” IRS Commissioner Doug Shulman said. “The IRS fights fraud by pursuing taxpayers who hide income abroad and by ensuring taxpayers get competent, ethical service from qualified professionals at home in the U.S.”

Tax schemes are illegal and can lead to imprisonment and fines for both scam artists and taxpayers. Taxpayers pulled into these schemes must repay unpaid taxes plus interest and penalties. The IRS pursues and shuts down promoters of these and numerous other scams. The IRS urges taxpayers to avoid these common schemes:

- Return Preparer Fraud

- Hiding Income Offshore

- Phishing

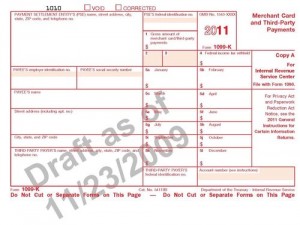

- Filing False or Misleading Forms

- Nontaxable Social Security Benefits with Exaggerated Withholding Credit

- Abuse of Charitable Organizations and Deductions

- Frivolous Arguments

- Abusive Retirement Plans

- Disguised Corporate Ownership

- Zero Wages

- Misuse of Trusts

- Fuel Tax Credit Scams