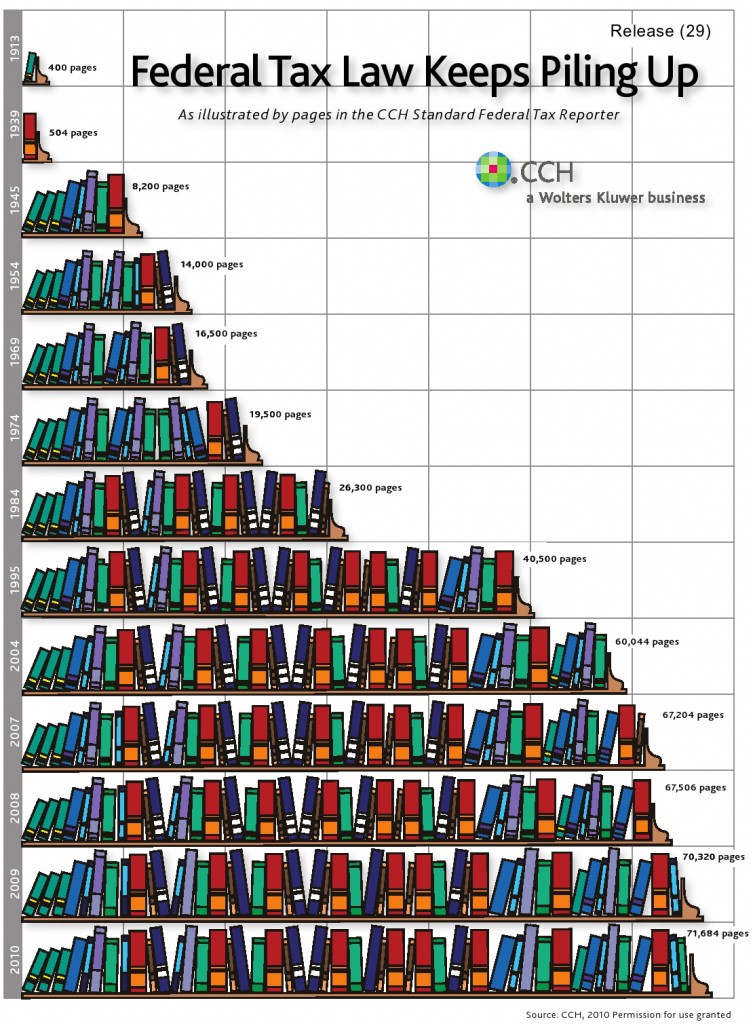

Don’t Mess with Taxes: “As you can see from this lovely graphic from the folks at CCH, interpreting the tax code gets tougher every year. Back when our current income tax code was put into place, CCH’s Standard Federal Tax Reporter needed 400 pages to examine the legislative, administrative and judicial aspects of the laws. That number held pretty steady until 1945, when it ballooned to 8,200 pages. By 1969, the pages of explanation had doubled. This year, the tax publishing company needed 71,684 pages to tell us all about our tax laws. As the hubby says, that’s just crazy!”

As a former-tax lawyer who took 18 semester credits of federal tax law related courses in law school and who holds a masters degree (LL.M.) in income tax law from New York University School of Law, I think it is outrageous that the federal tax law has become so bloated and incomprehensible. Why? Instead of using the tax code to to influence the behavior of people and companies, why doesn’t Congress throw out the entire tax code and replace it with a new tax law that says:

Tax owed = total amount of income you received last year times the applicable rate and have the applicable rate increase as the income increases?

Size of CCH Federal Tax Reporter

Leave A Comment

You must be logged in to post a comment.